Freezing temperatures in country’s largest growing regions raise concerns over next year’s crop.

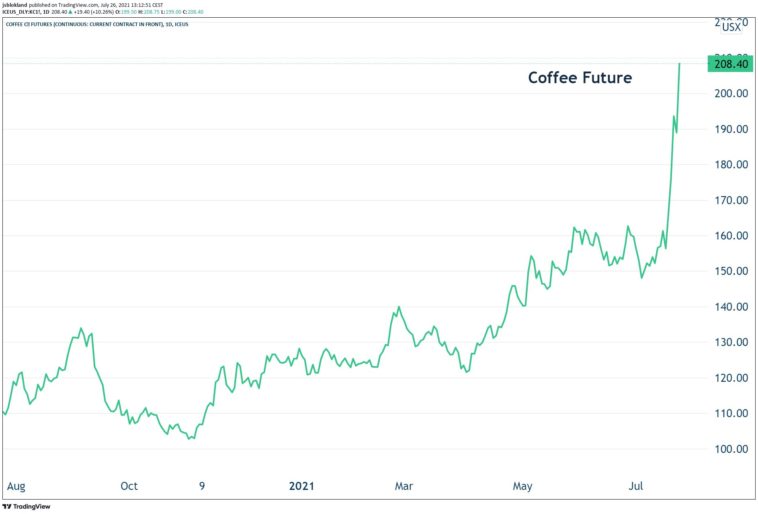

The New York futures price for arabica, the higher quality bean, rose above $2 a pound, a level not seen since October 2014, after a sharp fall in temperatures in Brazil’s three largest growing regions — Paraná, São Paulo and Minas Gerais — raised worries about next year’s crop – said the Financial Times.

This situation is giving to other countries with coffee to get the most from the high price in the supermarkets. Colombia, Guatemala and Mexico, are happy to announce best prices for their local farmers.

Prices are now up more than 30 per cent this week, and 60 per cent since the start of the year. The surge is likely to hit coffee lovers as roasters and supermarkets, including Tchibo of Germany and Japan’s UCC, had already started to increase prices because of the explosive market rally in 2021.

Traders said the frost had been more severe than anticipated, with many areas experiencing temperatures below 0C and falling to minus 5C in the worst-affected regions. The frosts follow a year in which Brazil, the world’s largest coffee producer and exporter, had been hit by the worst drought in a century, meaning trees were already weakened by heat stress.

“The damage from Brazil’s frost is much worse than we could have imagined and is resulting in a worsening outlook for the 2022-23 crop potential, which, coming after the current small drought-hit crop, is very worrying,” said Kona Haque at ED&F Man, an agricultural commodities merchant.

You may read: Colombian Alejandra Torres: Spirit of a Shark and Heart of a Woman

Analysts are downgrading estimates for next year’s crop by 5-10 per cent, although the damage could be worse and levels will depend on farmers’ pruning of trees.

If the damage is extensive, farmers would be forced to prune the trees hard, leading to a sharp fall in production, said Carlos Mera at Rabobank. A significant proportion of trees in the key coffee-growing areas of South Minas and Mogiana would have to be aggressively pruned, meaning no harvest next year.

Even if the trees are not pruned, the frosts will affect the flowering process for next year’s crop, creating further uncertainty in the market. Young trees, which need to be replaced would lead to a decline in productivity over the next three to four years, Mera added.

Weather forecasters are predicting that another frost will hit Brazil next week and coffee traders are braced for more price volatility. A small variation in temperature makes a big difference in the level of damage on the trees, said traders.

Coffee buyers are concerned that many farmers and exporters will “default” on their contracts, and not honour their agreements, seeking higher prices. One trader said while it was too early for such moves, he was “predicting them for sure”.